In 2016 and the years to come, renewable energy sources (RES) seen globally will no doubt increase their penetration into the electric systems in order to reach the goals of COP21 – limiting global temperature increase to 1.5 oC. In light of this truly historic Paris Agreement endorsed by nearly 200 countries, we urgently need to revise current EU and national RES targets. The currently defined EU’s 2030 climate and energy goals, e.g., a 40% emission reductions by 2030 compared to the 1990 level, simply will not get us there, even with a 27% RES target share for the final energy consumption. Only a stronger emissions target in line with the rapid decarbonisation of the energy sector and a higher share of renewable in the final energy consumption will make this goal achievable.

Regarding the total capacity installed in the EU by 2015, 141.6 GW was in wind and 95.4 GW in PV, accounting for 26% of the EU power mix. Good news is that wind accounted for a total of 12.8 GW, 44% of all new installed capacity in the EU, becoming number one in Europe among all energy sources. Solar PV came second with 8.5 GW, accounting for 29%, while coal took the third place with 4.7 GW (16%). Both wind and PV accounted for 73% of new energy installed capacity in 2015, overtaking the conventional power sources, such as fuel oil and coal for which more capacity is decommissioned than installed. This is an important milestone: today’s mix of energy use is at its turning point shifting from conventional fuel sources to renewable energy sources.

However, the transition from the old energy model, particularly in the electricity generation mix, cannot be simply left to the market forces when the intrinsic value of the different technologies is not fairly remunerated. A system approach is needed to value a flexible technology like STE based on its global “value”, instead of a simple “cost” of generation. Otherwise, significant drawbacks in both technical and economic terms are likely to arise.

Our recent joint report with Greenpeace and SolarPACES on STE’s Global Outlook 2016[1] indicates that STE is the key to achieve a 100% renewable share by 2050 in a wise mix with other renewables. It also estimates that the potential for STE to meet global electricity demand is far greater: the analysis based on the Advanced Scenario assumptions shows that STE could provide approximately 4,500 TWh of solar thermal electricity by 2050, delivering up to 12% of the world’s electricity needs. In this most optimistic scenario when only Sunbelt countries are considered, STE would save 1.2 billion tonnes of CO2 annually by 2050. Geographically speaking, although Europe is not the best place for STE plants, it is estimated that STE would deploy up to 35 GW in Europe by 2030 under aggressive deployment policy. To achieve this, the European energy mix should include a certain share of dispatchable renewable generation technologies. Therefore, in regard to STE, contributing a 0.5% share to the EU energy mix, further support and deployment is needed in order to bring the estimated scenarios to life. Right now it is more important than ever to adopt such a system approach.

However, this will unlikely happen without governmental support schemes. Current policies show that market will only be triggered by low costs and/or self-consumption strategies – mostly at distribution level and in many cases without consideration of the abundancy of the respective resource across Europe and the world.

Time has come to raise our look on energy policy a bit beyond LCOEs[2] and its resulting deployment plans based on pure cost-based auctions. This metric may remain for academic purposes, but it is not supportive to a far-reaching energy policy-making that leading to system planning decisions and support schemes. The value of flexibility enabling a responsive behaviour of plants according to the demand, capacity availability, grid stability, energy security, local economic impacts including effects on job creation, impact on trade balance, etc., are not addressed in a “LCOE approach”. The current almost-addictive reference to the lowest generation cost does not build on the essential distinction between ‘value’ and ‘cost’ related to the various renewable technologies.

The guiding principle to date should no longer be “how much a generated kWh” in a given plant will cost in terms of CAPEX/OPEX over its 20-to-25-year lifetime (which is for STE plants systematically underestimated as the effective lifetime reaches 40 years). Instead, the value added to the system by this kWh should be the core term. This value can be expressed both in operational terms (time-of-day effective operation hours, impact on spinning capacity reserve contribution to ancillary services, induced generation curtailment, etc.) and in terms of added capacity (investments avoided to cover demand in all timeframes on top of the investment of the new plant itself). However, technologies like STE that deliver such added value cannot yet do it at large neither in Europe, nor worldwide – because neither were these plants designed for it, nor does the electricity market design offer a specific segment where RES generation technologies can compete for firm deliveries on demand.

[1] Solar Thermal Electricity: Global Outlook 2016, Greenpeace, ESTELA, SolarPACES, 2016:

[2] LCOE: levelized cost of electricity

Onshore wind and PV have reached already competitive cost levels, at about 6 c€/kWh on average, with 400 GW of onshore wind and 200 GW of PV installed worldwide. With only 5 GW installed capacity, STE has reached now the cost at 14 c€/kWh at relatively good sunny places. When both wind and PV technologies had a power installed equivalent to the 5 GW of STE as of today, their prices were much higher than the current one of STE. The cost of STE could be close to the same price levels of wind and PV if STE’s installed capacity was multiplied by 80 (wind) or 40 (PV) in order to compare at the same level of installed capacity. Therefore, the potential for cost reduction of STE technology that could be achieved is large, at the given corresponding market volume.

So the current price gap between STE plants and Wind or PV plants can be partly reduced only when the value-to-the-system is considered. The still remaining gap would be automatically compensated by the growth of the STE market, i.e., based on maturity. STE would not even need to reach the same level of current wind or PV installed capacity, even 10 times less than what they have archived will be enough to demonstrate the full competitiveness of STE power plants.

Last but not least, aren’t we comparing apples to pears when comparing STE and PV plants?

The ratio of Cost/kW is definitely not the right indicator. Comparisons must be made at least in terms of investment for the same yearly production. But even the ratio of Cost/kWh produced is not the suitable indicator either.

When considering the electricity generation costs in a power system in its full dimension, what matters is not only the project cost of a given project to a system, but the hidden benefits brought to a system by such a given project: this is the “value”.

However, many aspects are usually disregarded when calculating the power generation costs, for example, lifetime of components, degradation of performance, impact of temperature on performance, losses in charging and discharging batteries, pumping stations, etc.

As electricity cannot be stored in the grid, power generation must be necessarily equal to or following the demand curve of consumption. Flexibility in the system can be achieved in various ways: storage of surplus energy, demand-side management, interconnection with neighbouring systems and dispatchability of the generation units.

Any new power plant in the system provides services at a given cost.

Since intermittent renewable plants usually are not able to provide firmness of supply, the increased cost for integrating intermittent renewable generation sources into grid operation is primarily the costs for additional conventional power needed as back-up.

Furthermore, the interconnection costs are the costs for any transmission infrastructure and operational measures by TSOs needed to inject the intermittent renewable energy into the high-voltage grids. Such operational measures include capacity allocation on transmission lines and any re-dispatching measures depending on whether a plant can provide ancillary services (e.g., regulation, spinning/non-spinning reserves, and fast ramping up or down) or not.

Finally, more benefits can also arise, such as impacting costs due to the location of the plant that can reduce the need for new infrastructure, impact transmission congestion or be made available to a utility facility using any surplus capacity for its auxiliary services.

The two-fold types of value for a new generation unit can be summarized as follows:

Operational value represents the avoided costs of conventional generation at their respective dispatching times along with related ancillary services costs, such as operating reserve requirements. Savings on emission costs are also accounted. Apart from this, another potential value is firm capacity.

Capacity value reflects the ability to avoid the costs of building new conventional generation in response to growing energy demands or plant retirements.

But the above mentioned costs are only one of the parameters to be valued ahead of any decision to invest in renewable technologies.

The difference

in “added-value to the system” of the various technologies depends certainly on the country considered and the ease for its assessment in the respective country’s electrical system. Dispatchable technologies will be highly valued in countries that need to double their installed capacities in the next decade. Nevertheless, some industrialized countries which can show today important back-up capacity might be concerned since an increasing number of old nuclear or coal plants will need to be decommissioned.

An interesting study on this regard has been carried out by NREL not only presenting the different values between a new PV plant and a STE one with storage in the short term, but also demonstrating how this difference changes depending on the progressively increasing penetration share of renewable technologies in their generation mix.

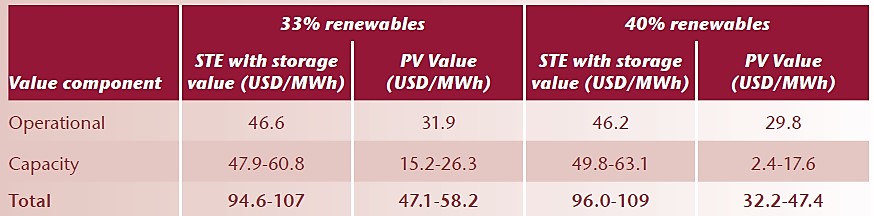

Figure 2: Example for 33% and 40% RE shares in California (NREL, May 2014) [1]

Currently California has a 33% Renewable Portfolio Standard (RPS) for 2020, which means 33% of retail electricity sales must come from eligible renewable energy resources. The Californian authorities stated that a share of 40% renewables is achievable in the near future at reasonable cost. In this study, NREL has compared the relative value of PV and STE (with storage) under a 40% RPS scenario.

The main conclusion is that with a 33%-penetration of renewable energy in California, it is economically equivalent to pay 5 US$ cents/kWh to a new PV plant and 10 US$ cents/kWh to a STE plant with storage. Moreover, this difference increases along with the share of renewable energy.

The results of the study clearly show that STE with storage has a higher marginal operational value than PV and that the relative value may increase slightly with increased PV penetration. As shown in Figure 2, the operational value in reduced generational costs for PV in a 33% RPS case is $31.9 USD/MWh and for STE is $46.6 USD/MWh; while in a 40% RPS case, the operational value is $29.8 USD/MWh for PV and $46.2 USD/MWh for STE. A significant portion of STE value appears to be derived from its ability to provide firm system capacity.

The current power market design rules are being revised in many countries, particularly in the EU. In this context, “flexibility products” could be defined with the system operators for different kinds of services where the value of dispatchability would be reflected.

In case a future market design would fall short of changing its rationale compared to the current one, it will be up to regulators and system planners to duly assess the value rather than just using the pure marginal cost approach, so as to make the energy model transition sustainable, efficient and also affordable.

The technologies that deliver this added value, such as STE plants, cannot yet do it at large neither in Europe, nor worldwide. The reason for that is common sense: neither were these plants designed for it, nor does the electricity market design offer a specific segment where RES generation technologies can compete for firm deliveries on demand.

Last but not least, due to their respective low market volume, flexible RES technologies have already achieved a substantial, but slower cost reduction curve compared to non-flexible RES technologies.

The conclusion in DNV-GL’s CSP optimization report carried out for the California Energy Commission states clearly that STE coupled with thermal energy storage can improve both economics and technical performance of the system:

STE plants can cover a wide range of needs:

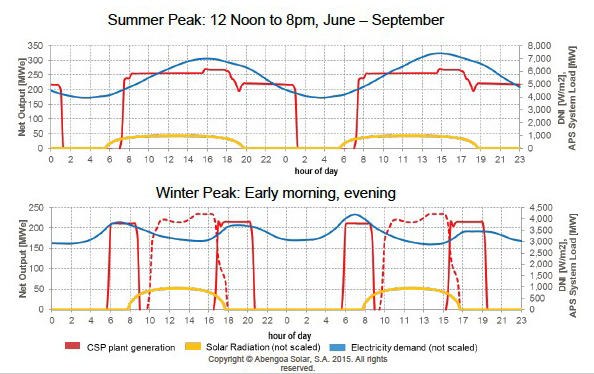

The following figure shows the example of Solana plant in Arizona and how it can meet various system operator needs:

Figure 3: STE Flexibility: Dispatching Power when Most Needed. Source: Abengoa Solar

This plant contributes to the supply of the demand during the long summer peak while in winter electricity can be dispatched during the early morning and evening peaks. This example clearly shows that value for the system is far beyond the generation cost.

[1] Jorgenson, J., P. Denholm and M. Mehos (2014), Estimating the Value of Utility-Scale Solar Technologies in California under a 40% Renewable Portfolio Standard, NREL/TP-6A20-61695, May.